JOHOR BAHRU : FOMCA : Move to reduce fossil fuel usage

- Details

JOHOR BARU: Efforts to reduce fossil fuel usage by 20% and green house gasses by 45% has got the government looking to the sun for clean, green and renewable energy solutions.The government hopes to meet these numbers by 2025 through the use of readily available renewable energy sources, like wind and the ever-abundant solar energy.Energy, Science, Technology, Environment and Climate Change Ministry’s under-secretary Wong Tin Song said this was a significant increase from the previous renewable energy target.“In 2017, the government set a target to the power sector to utilise 2% of renewable energy, ” he said in his speech at the Conference on Energy Efficiency held at Berjaya Waterfront Hotel Johor Baru.“To achieve this, we need to increase the amount of solar energy in our total electricity generated, ” he said, adding that currently solar power makes up 6.6% of the total energy supply.

Wong also mentioned that energy efficiency plays an important role in transforming the energy system in Malaysia.“Reducing the demand for electricity is the least expensive approach to meet our goals, ” he said, adding that the government was working together with NGO’s like the Federation of Malaysian Consumer Association (Fomca).

Read more: JOHOR BAHRU : FOMCA : Move to reduce fossil fuel usage

FOMCA: Budget and the Healthcare Consumer, Dato Paul Selvaraj, CEO FOMCA

- Details

For Budget 2020, the total of RM30.6 billion as compared to RM28.7 billion under 2019, has been allocated for healthcare; an increase of 6.6%. FOMCA fully supports the increasing investment in public healthcare. Further, it fully supports the continuing strengthening of public healthcare. With this increasing investment, more hospitals can be built as well as health and dental clinics can be upgraded. Currently, the public hospitals have about 16,000 bed shortages. The increase in allocation could help to reduce the bed shortages in government hospitals, enabling more patients who need critical treatment to be warded.

However, one of the greatest limitations in public hospitals is the shortage of specialists. Currently about 30% of specialists and 45% of doctors serve 65% of the population in public hospitals. The rest of the specialists and doctors serve about 25% of the patients in private hospitals. Certainly it is more lucrative to serve in private rather than the public service. Further, there are some specialised areas in which there is an acute shortage of specialists in public hospitals for example in areas of nephrology and neurology. Thus it is proposed that government should take active measures to train and recruit specialists for the public sector. More importantly, there needs to be better measures to ensure that trained and specialised doctors continue to serve in the public service. Healthcare is an essential service, special measures to keep specialists in the public service should be supported.

In addition, to ease the burden of the public healthcare services, government should play a robust role in regulating the private sector. Private healthcare is exorbitantly expensive. Prices are not regulated, thus consumers end up paying a hefty sum they can ill-afford for treatment. What is worse, many consumers do not have medical insurance. In fact, 38% of consumers pay their hospital bills by out-of-pocket expenses, considered the most risky form of payment. Out of pocket payments have risen from RM 2.93 billion in 1997 to RM 17.44 billion in 2013, a rise of about 29% per year. Further, medical insurance premiums have been skyrocketing, making it unaffordable to low and middle income consumers. For a start, FOMCA suggests greater transparency in pricing by the private hospitals so that consumer make an informed decision when choosing private treatment as well as be well aware of the potential costs.

Read more: FOMCA: Budget and the Healthcare Consumer, Dato Paul Selvaraj, CEO FOMCA

FOMCA : Budget 2020 and House Buying Consumers, Dato Paul Selvaraj, CEO FOMCA

- Details

Houses in Malaysia are simply unaffordable for many Malaysians. There is a serious mismatch between incomes and house prices. According to Khazanah Research Institute and Bank Negara Malaysia, the signal of a well-functioning affordable home market is when the median price for the whole housing market is three times the gross annual household income. Bank Negara would add that the monthly payment for the house should not be more than 30% of the income. Payments of more than 30% would be considered as an overburden for the consumer.Based on the above criteria, Bank Negara would suggest that an affordable home in Malaysia based on the monthly median income of RM4, 585 and the annual median income of RM 55,020 is between RM 165,000 and RM 242,000. Yet what is the current price of houses?

Overall in Malaysia, houses prices are 4.4 times the median income. Further, zeroing in on the states, house prices in Kuala Lumpur is 5.4 times, in Pulau Pinang is 5.2 times, in Johor is 4.2 times and in Selangor is 4.0 times. Further while according to Bank Negara the affordable home is at RM 242,000, in actual fact the average price of houses in Kuala Lumpur is RM 773,000,while in Selangor it is RM 497,000 at the third quarter of 2018. To put it simply, houses in Malaysia are simply not affordable to consumers.The efforts, through policy and programs then, should be to reduce the price of houses to the affordable range of about RM 250,000 to RM 300,000. Yet, in 2016 only 25% of new housing launches were priced below RM 250,000. There was a gross oversupply of houses above RM 500,000 and under-supply of houses below RM 250,000. No wonder the mismatch between demand and supply.

Read more: FOMCA : Budget 2020 and House Buying Consumers, Dato Paul Selvaraj, CEO FOMCA

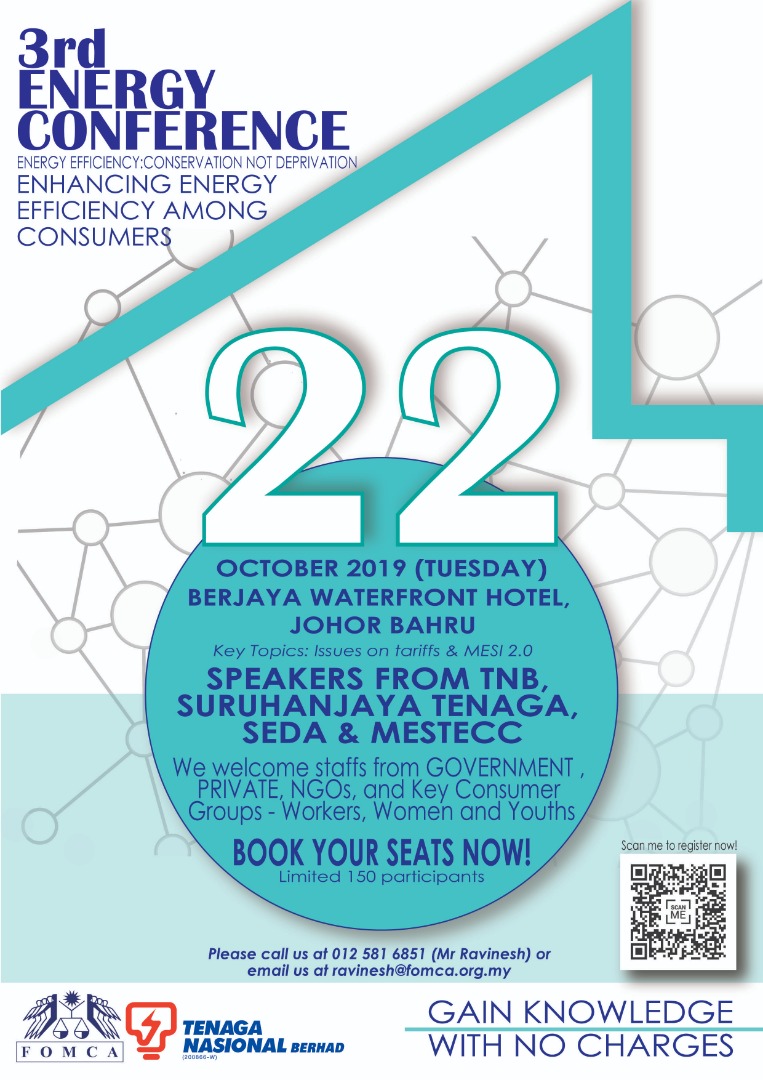

ENERGY CONFERENCE 2019: "Energy Efficiency:Conservation.Not Deprivation"

- Details

We are honored to invite you to the 3rd Energy Conference titled " Energy Efficiency:Conservation.Not Deprivation" An additional step forward in educating people from multiple sector on energy efficiency and current energy related practices in Malaysia. The event will be held in collaboration between Federation of Malaysian Consumer Association & Tenaga Nasional Berhad at the Berjaya Waterfront Hotel , Johor Bahru on Tuesday , 22nd October 2019 at 8.00 a.m to 4.30 p.m. The event is free of charge and the seats are limited, so book your seats now either by scanning the qr code or visiting this link :https://www.eventbrite.com/e/energy-conference-tickets-73919448059

FOMCA: FINANCIAL LITERACY by Mr.S.BASKARAN, SENIOR MANAGER, FOMCA

- Details

Financial Education Network was finally launched by our PM recently. The former Bank Negara Governor, Muhammad Ibrahim on 15th November 2016 announced the establishment of a Financial Education Network (FEN) to coordinate and drive a national financial education strategy in Malaysia. Bank Negara initiated the idea of FEN and co-chaired with Securities Commission of Malaysia. The High Level Inter-Agency Steering Committee was supported by working groups established to drive specific initiatives. The initial members comprising of Ministry of Education (MOE), Perbadanan Insurans Deposit Malaysia (PIDM), Employees Provident Fund (KWSP), Credit Counselling and Debt Management Agency (AKPK) and Permodalan Nasional Berhad (PNB). Besides these ministry and agencies, the FEN also worked with other relevant government ministries, industry associations, consumer groups and other key stakeholders to deliver, monitor and measure financial education initiatives under a coordinated national strategy.

Since 2011, Federation of Malaysian Consumers Association (FOMCA) together with Education and Research Association for Consumers Malaysia (ERA) has proposed to the Government to form a National Financial Education Commission to integrate and coordinate financial education for all sectors, including schools, young workers, community and families to be taught in schools to create awareness among young Malaysians on how to manage their finances. An important plight felt on deft ears and it was not implemented. Hence, today many youngsters and young executives are bogged down with debts. It took almost 5 years for Bank Negara to embark on this vital issue and another 3 years for the network to materialize. But how long more will it take for the FEN to implement in the school curriculum rather than in stages?

Read more: FOMCA: FINANCIAL LITERACY by Mr.S.BASKARAN, SENIOR MANAGER, FOMCA

FOMCA: 2019 Global Financial Consumer Forum

- Details

FOMCA's President Prof Emeritus Datuk Dr Marimuthu Nadason have attended the 2019 Global Financial Consumer Forum on behalf of FOMCA.The IAFICO is a global communication platform for scholars, regulators, and practitioners to present their latest research and share insights about protection for financial consumers as well as international development cooperation in finance.This conference will examine the potential of financial technology to advance financial inclusion, changing consumer protection and regulatory needs, and emerging opportunities for greater international development cooperation in finance. The focus areas will include evolving consumer behavior, business ethics and best practices of financial institutions, regulatory safeguards, and financial education.

MALAYSIAKINI: Haze gone but river polluters are back at their dirty acts, Saravanan Thambirajah, President WECAM

- Details

LETTER | Malaysians were relieved when the monsoon arrived with plenty of rain which has reduced air pollution caused by haze. But the crafty polluters were happy because this is a golden opportunity for them to discharge all their illegal toxic waste into rivers. This is their modus operandi as they thought the heavy rain will wash away the toxic waste.Sadly, the reality is almost all consumers in the Klang Valley have to face water disruptions. The Semenyih river treatment plant had stopped operating due to pollution again. This is like an annual phenomenon for Malaysians, especially those in the Klang Valley. Consumers have to pay the price because of the illegal activities caused by these greedy polluters.

Water and Energy Consumers Associations of Malaysians, Federation of Malaysian Consumers Associations and many pressure groups have been monitoring this issue every year and exerted tremendous pressures on the current and previous governments. Yet, this issue still continues to occur as if it is an annual event. The promises made by them to look into the matter are always not kept or fulfilled.Even though this issue occurs every year, there is not much action taken by the government to monitor this illegal toxic waste dumping by some arrogant and irresponsible factories and business operators. These polluters will never stop polluting our rivers as this is the cheapest method to discharge all their chemical waste into the rivers.

STAR ONLINE: SPAN seeks stiffer penalties,SARAL JAMES MANIAM, MALAYSIAN WATER FORUM, President

- Details

PETALING JAYA: With water cuts due to pollution fast becoming a regular occurrence across the country, the National Water Services Commission (SPAN) wants to impose stiffer penalties on polluters.SPAN chairman Charles Santiago said tougher penalties and enforcement efforts must be in place to preserve the quality and cleanliness of the water supply.“The government must come up with policies and laws with stringent penalties, especially for factories, individuals or sewage plants dumping their waste into the rivers.“The penalties should go right up to the owners of the offending companies and they should not be allowed to run their business for five years after they have been found guilty, ” he added.This followed a water supply cut affecting 372,031 households in the Petaling district, Hulu Langat, Kuala Langat and Sepang in Selangor.

Although the water treatment plant in Semenyih resumed operations 13 hours later, Air Selangor said it was the fourth incident this year involving a main plant, leading to large-scale unscheduled water cuts.As at 1pm yesterday, Air Selangor reported that 47% of supply had been restored.In June, odour pollution was detected in the raw water source in Sungai Semenyih.On July 19, another odour pollution was detected in the raw water source in Sungai Selangor.A few days after that, diesel contamination was detected in the water source in Sungai Selangor, resulting in four water treatment plants having to shut down.Although there were suspicions of sabotage, Inspector-General of Police Tan Sri Abdul Hamid Bador ruled it out as a cause of the pollution.He said the diesel spill was more likely due to the negligence of the company’s employees.Santiago said education must go hand in hand with penalties as the “biggest culprits” were those who did not understand the importance of protecting the country’s water sources.

Muhammad Sha'ani Abdullah, Malaysian Digital Economy : Bank charges hinder cashless adoption, burdens poor

- Details

LETTER | Unfair bank charges have been highlighted by Fomca for a very long time since charges were imposed for ATM cards against bank passbooks which were provided free of charge. Though the often claimed automation and computerisation are to reduce costs for consumers but it was the opposite for many of the financial services.We all should embrace and promote a cashless mode of payment for safety, efficiency and convenience. However, such efforts to encourage adoption of a cashless mode should not burden any segment of the consumers. With the consolidation of banks and cost rationalisation, most small towns are not serviced by all banks.Consumers are bound to have and operate their bank accounts in certain banks due to certain obligations such as loan facilities or for crediting of salaries and so on. As such, many consumers are not free to choose their banks.Informal sectors low-income earners are paid daily and bank-in their incomes and may make frequent withdrawals for expenses. Banks charge a 50 sen withdrawal fee for withdrawals more than five times in a month. Cash withdrawals from ATMs of different bank incur a RM1 charge.Is it fair to impose a 50 sen or RM1 fee for a withdrawal of RM50? The ATMs of foreign banks (licensed and operating locally) impose a much higher charge for withdrawals. Many would also would have encountered situations where one’s bank ATM is offline or not located in certain localities when the need for cash arises.

NST: No more charging fees for credit card and finance repayments

- Details

Banks will now cease charging fees for cheque and cash payments for credit card and financing repayments over the counter and at cash deposit machines.The Association of Banks in Malaysia (ABM) said in a statement today that for walk-in customers, there are free and convenient alternatives to conduct banking transactions such as via automated teller machines.“Currently, certain customer segments are already waived from these charges, such as for disabled persons and senior citizens,” the association said in a statement today.ABM said its member banks would be communicating with customers via their respective communication touchpoints, including the banks’ websites.

They have also ready to assist their customers to familiarise themselves with these alternative channels or on any queries they may have in relation to this matter, it added.Earlier this week, the Consumers Association of Penang and National Union of Bank Employees criticised the move to allow banks to impose a 50 sen charge for use of the cheque deposit machines and RM2 for over-the-counter transactions, beginning next month.In response to the criticism, the association said yesterday the fee was to push customers to use the online banking platform.ABM represented 26 commercial banks in the country.

- Bernama

Page 110 of 155