FOMCA : Saral James Maniam, Secretary General Standards Users,Facing disruptions: Risk management crucial for MAHB

- Details

AT least two dozen flights were delayed on Aug 21 when a systems disruption affected Kuala Lumpur International Airport (KLIA) and klia2, including its flight information display system, check-in counters, baggage handling systems and Wi-Fi.This should be a wake-up call for Malaysia Airports Holdings Bhd (MAHB). Based on the current global political climate, there has never been a more important time for airports to seriously reconsider their approach to cybersecurity and risk management.MAHB must oversee threats to the airport system and the management must further discuss it with the board and stakeholders.

Risk management is important to gain a competitive advantage.Through enhanced risk management, the board will gain a better understanding of how threats can impact its strategy.It is vital for MAHB to consider ISO 31000 Risk Management to identify, assess and control risks.Risk management ensures the highest possible level of safety during all airport activities and requires an in-depth risk analysis and incident analysis, as well as linking the two together to facilitate learning from incidents.Risk management will add value to MAHB and ensure continuous improvements. It improves performance, encourages innovation and supports the achievement of MAHB’s objectives.

The risk management process involves the systematic application of policies, procedures and practices to the process of communicating and consulting, establishing the context and assessing, treating and monitoring risk.Risk management has played a strong supporting role at the board level. Now, boards are expected to provide robust oversight of risk management.ISO 31000 also provides important information to boards so that they can fulfil their risk oversight responsibilities.

THE STAR:Crafty agents, naive consumers, S.Baskaran,NCCC

- Details

Malaysian consumers are being misled into purchasing products or services incorrectly. At the National Consumers Complaint Centre (NCCC), many people who sought help complained of agents from insurance companies who promised rebates or other benefits that were not valid. Sales agents have to reach targets set by their companies. To do so, the unethical ones may resort to giving false promises. Upon signing up, victims discover that the promises cannot be fulfilled.

According to the NCCC, almost 500 consumers complained last year about issues related to refunds and misleading information given by insincere agents. Insurance companies should consider conducting training for new agents to ensure they know their products comprehensively. They must make it compulsory for new agents to pass stringent examinations that encompass all issues related to insurance before endorsing people as qualified agents. These agents should also be tested by senior agents through peer group training or mentoring, whereby the new agents could be exposed to mock simulation situations in which many questions will be put to them by senior agents posing as inquisitive customers.

Read more: THE STAR:Crafty agents, naive consumers, S.Baskaran,NCCC

FOMCA, Dato Paul Selvaraj : Break the Touch N Go Monopoly

- Details

It is time to break the Touch N Go Monopoly. Touch N Go continues to serve consumers with shoddy products and poor services. It can continue to make profits despite providing poor products and services because it is a monopoly. There are no competitors. Consumers do not have a choice. Realising the unfair and weak position of consumers in relation to the monopolistic behaviour of Touch N Go, FOMCA on the 30 October 2018 filed a complaint with the Malaysian Competition Commission to investigate and more importantly break the monopoly. To date, Touch N Go continues its monopolistic behaviour to the determinant of consumers’ wellbeing.

It is way past time to break the monopoly and liberalise the market.

The time has come for the government to relook at the monopoly being enjoyed by Touch N Go and its impact on consumer protection and consumer wellbeing. And most importantly act on it.

As a monopoly, FOMCA strongly feels that consumers are getting a shoddy deal paying higher prices for lower quality of services. Some of the complaints received from consumers include:

Read more: FOMCA, Dato Paul Selvaraj : Break the Touch N Go Monopoly

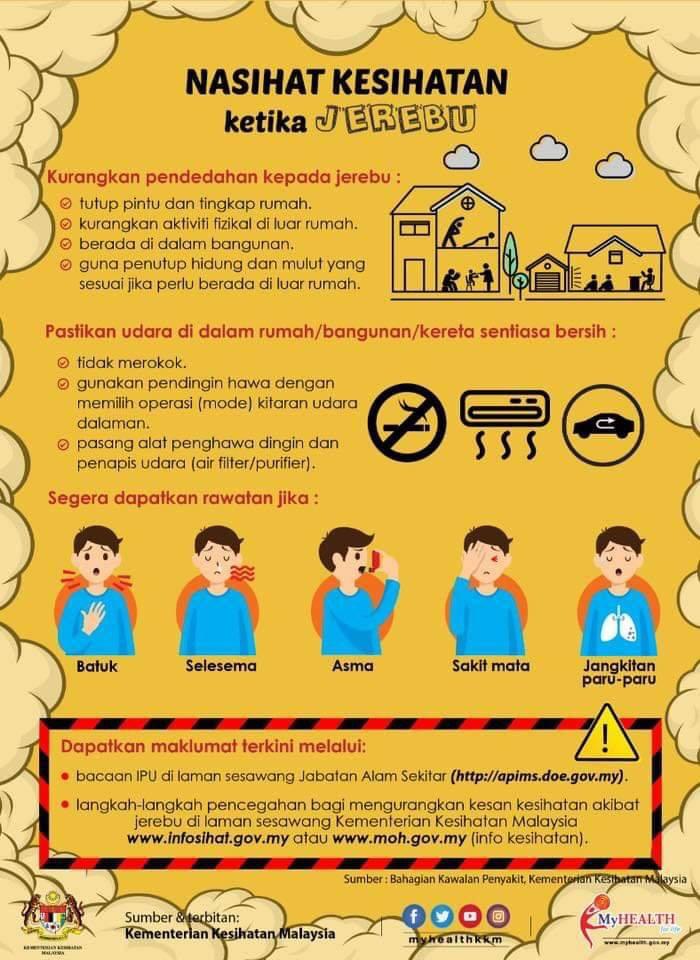

MK : Malaysia voices concern over haze with Indonesia

- Details

Malaysia has reiterated its concern on the impact of persistent transboundary haze to the Malaysian public and its offer to assist Indonesia in extinguishing forest fires in Kalimantan and Sumatera.This was conveyed at a meeting today led by Energy, Science, Technology, Environment and Climate Change Minister Yeo Bee Yin (photo, above) with Indonesian embassy's Minister Counsellor Agus Badrul Jamal and Counsellor for Information, Social and Cultural Affairs, Agung Cahaya Sumirat.She was joined at the meeting by officials from her ministry as well as the Foreign Ministry.“On the diplomatic front, we received updates from the Foreign Ministry that Malaysian ambassador to Indonesia Zainal Abidin Bakar had met up with Indonesian senior officials yesterday to discuss the transboundary haze currently affecting Malaysia,” she said in a statement posted on Facebook.According to Yeo, the Indonesian government was coordinating with relevant institutions to ensure concerted actions were taken to address the root cause of the problem.

Indonesia, she said, had conveyed its commitment to managing the transboundary haze issue including by deploying 1,994 personnel in Sumatera and 860 personnel in Kalimantan with another 1,677 volunteers having been roped in to help extinguish the forest fires.Yeo said 16 helicopters..

Read more: MK : Malaysia voices concern over haze with Indonesia

NST: Consumers to enjoy more affordable rates with liberalised market

- Details

KUALA LUMPUR: Contestable market or liberalisation in the local utility sector is vital as it provide consumers alternative solutions with more choices and flexibility when buying electricity.Accenture Singapore Asean Smart Grid Services Lead managing director Lim Chih Shoong said liberalised electricity market provides consumers with competitive pricing and innovative offers while enjoying the same electricity supply."A reduction of up to 26 per cent in utility prices has been observed in Singapore from this market contestability.

"We also expect Malaysia to have different electricity tariff if the country goes into full-retail contestability, making it cheaper (cost-competitive) for consumers to choose their electricity supply," he told the New Straits Times in an interview recently.It was reported that Malaysia is looking to liberalise its utility sector but the government has yet to set any conditions on the supply generation and mix.Lim believed the liberalisation would be a good move towards promoting more sustainable electricity ecosystem in Malaysia which can play a part in reimagining Malaysia for the future.“This is because open electricity market allows the dominant utility company and new players to innovate their products and services for consumers,” he added.

Read more: NST: Consumers to enjoy more affordable rates with liberalised market

BERNAMA : New water tariffs for all states possibly by end of the year

- Details

The new rates for water tariff in all states may be announced at the latest by the end of the year.However, Water, Land and Natural Resources Minister Xavier Jayakumar said that before his ministry makes any announcement, the matter will be brought to the cabinet for discussion.“I will only announce the tariff increase in each state after the cabinet ministers have agreed with the new rates."Maybe by the end of the year, but I cannot promise anything,” he told reporters after flagging off the 2019 Peace Run in Morib today.Also present were Soka Gakkai Malaysia (SGM) secretary-general Lok Chee Khong and Morib assemblyperson Hasnul Baharuddin.About 1,500 participants joined the run which was held outside of Klang for the first time since it was organised by SGM in 2005.When asked on the percentage of water rate increase which consumers can expect, Xavier said his ministry will ensure the tariff raise will not burden the people."We understand the people's situation, but the people should understand that the water industry has not changed its rate for a long time and it needs larger operation capital now,” he said.

- Bernama

ASKLEGAL: SEBAB UTAMA KAEDAH SAMBUNG BAYAR TIDAK SEPATUTNYA DIAMALKAN

- Details

Lima (5) sebab utama mengapa kita tidak sepatutnya membuat urusan membeli kenderaan kaedah Sambung Bayar dari sudut undang undang.

Kereta kini sudah menjadi satu keperluan dalam setiap keluarga. Namun untuk memilikinya menjadi satu masalah. Ramai yang ingin memiliki kereta tetapi tidak dapat kerana masalah mendapat pinjaman pinjaman dari bank. Ramai juga yang membeli kereta terpakai melalui pinjaman bank bagi mereka yang layak. Malangnya ramai yang masih tidak memenuhi syarat untuk mendapatkan pinjaman. Mereka yang tidak layak memilihi kaedah yang lebih mudah tetapi berisiko iaitu skim sambung bayar.

Bagaimana skim Sambung Bayar ini berfungsi

Kebiasaannya, pemilik kereta ingin menjual keretanya walaupun masih membayar pinjaman kereta tersebut. Pemilik kereta ini tidak mahu menjual kereta kepada syarikat yang menjual kereta terpakai kerana dia akan kehilangan wang yang banyak dan juga memerlukan wang tunai. Di pihak pembeli pula, dia hanya perlu wang pendahuluan yang kecil di samping menyambung bayaran bulanan pemilik sebenar. Tambahan pulak, pembeli tersebut tidak perlu memohon pinjaman bank.

Read more: ASKLEGAL: SEBAB UTAMA KAEDAH SAMBUNG BAYAR TIDAK SEPATUTNYA DIAMALKAN

UTUSAN : Perbankan Internet tidak selamat?

- Details

KUALA LUMPUR 29 Ogos - Kaji selidik yang dijalankan Pusat Penyelidikan Kaji Selidik Universiti UCSI mendapati lebih separuh penduduk di sekitar Lembah Klang berpendapat penggunaan perbankan Internet tidak selamat kerana terdapat keburukan dalam sistem pembayaran elektronik.Ketua Eksekutif Pusat Penyelidikan Kaji Selidik UCSI, Penolong Prof. Dr. Noppadon Kanika berkata, perbankan dalam talian boleh menjurus kepada pencerobohan maklumat peribadi, pelbagai jenis scam, penggodaman, kecurian identiti dan sebagainya.Menurutnya, kajian tersebut melibatkan sejumlah 65.5 peratus daripada 551 penduduk yang dijalankan pada 1 hingga 27 Ogos lalu dan berdasarkan kajian itu majoriti penduduk di Lembah Klang menggunakan perkhidmatan perbankan dalam talian bagi pelbagai tujuan transaksi.

“Hasil kajian ini menunjukkan terdapat 457 individu yang menggunakan sistem pembayaran dalam talian sekurang-kurangnya melalui satu atau dua bank. Walaupun mereka berasa takut dengan risiko menggunakan perbankan dalam talian, 7.5 peratus daripada responden mengakui bahawa mereka melakukan transaksi wang secara dalam talian kerana ianya lebih cepat dan mudah.“Ramai yang berasa senang apabila menggunakan perkhidmatan bank dalam talian, walaupun mereka takut dengan kewujudan penggodam dan pencerobohan identiti yang boleh berlaku.

THE STAR : No mercy for water polluters

- Details

SEREMBAN: The state government has threatened to revoke immediately the operating licences of businesses caught polluting raw water resources, says Mentri Besar Datuk Seri Aminuddin Harun.Drawing upon the lessons from several recent episodes of river contamination in the Klang Valley which disrupted supply of treated water to tens of thousands of consumers, he said the Negri Sembilan government had decided to issue a warning to would-be-polluters that the state was no longer in a mood to compromise.“There will be no more talking or discussing things because we have been getting many complaints of rivers being polluted here.“If you are found to have contaminated a drinking water source we will take drastic measures as you are not only inconveniencing the state government and the public but the very act can be a potential health hazard, ” said Aminuddin here yesterday.

Aminuddin urged the public to notify authorities if they come across any party releasing untreated effluent into the environment.“I have seen rivers clogged with garbage and other waste, but thankfully, these did not cause the river to be polluted.“I have told all enforcement agencies, including local councils, the Environment Department and the state water regulatory body (BKSANS) to be strict in their enforcement, ” he said after closing a seminar on licensing needs for companies drawing raw water from the state, be it from the sea, rivers or ground water.Aminuddin said all industries, including those involved in sand mining, should take heed of his warning.

Page 112 of 155